The past few days saw two Boeing 737 MAX aircraft meant for Chinese carrier Xiamen Airlines return from China to Boeing’s production hub in Seattle. Boeing jets flying in and out of Seattle is a regular affair, but these flights were anything but routine. For they represented the tariff war flying right in face of the aviation industry, which is among the most globalised and internationally integrated sectors.

With and Beijing returning the favour, the effective price of the aircraft for Chinese carriers would have skyrocketed. Besides, there have been reports that Beijing has asked its airlines to halt aircraft deliveries from Boeing, virtually locking out the US aerospace major from a top aviation market. Moreover, the development indicates potential disruption in aircraft deliveries even beyond China as the implications of American trade tariffs — and reciprocal levies — begin to play out.

The international aviation sector would be bracing for headwinds due to the tariffs. To be sure, there is considerable uncertainty around the tariff war, mainly due to the mercurial behaviour of the administration. Much of the world, including the aviation and aerospace industry, would be hoping and praying for a quick dialling down of the trade tensions. But if the tariff war goes on unabated or intensifies, it could get painful.

A fleeting silver lining for some airlines?

While aviation industry insiders and trade experts warn that tariffs are particularly detrimental to a globally integrated sectors like aviation as they drive up manufacturing costs and complicate supply chains, among other negatives, there may be a silver lining for some Boeing customers including Indian carriers Air India Express and Akasa Air, at least in the short term.

If Chinese airlines continue to refuse Boeing aircraft deliveries going forward, they could be up for grabs for other carriers who want to quickly expand their fleet to fuel growth. Over the past few years, Air India Express and Akasa Air inducted dozens of Boeing aircraft that were originally meant for other airlines—mainly Chinese carriers—who could not take deliveries on time.

Both the Indian airlines still have a large number of Boeing planes on order with multi-year delivery schedules, and are expected to capitalise on opportunities to expedite deliveries. They are not alone though and might have to compete with carriers from other countries. Reports suggest that Malaysia Airlines is in talks with Boeing to acquire some of the 737 MAX jets originally meant for Chinese airlines.

Brace for impact, uncertainty

The status of aviation as one of the most globalised industries cannot be overstated. From facilitating worldwide transportation of people and goods to having a truly expansive international supply chain for aircraft manufacturing and maintenance, the sector is a true poster child of globalisation. And like for any globally integrated industry, international tariff war could hurt the sector — from aircraft manufacturers and their suppliers to airlines, and ultimately flyers.

For starters, the cost of producing aircraft could jump significantly. This is because aircraft manufacturers like Boeing and Airbus depend on global supply chains with highly specialised and difficult-to-replace component suppliers dotted across the world. So, while a Boeing jet may be assembled and readied in the US, it is actually manufactured in various countries as its components are sourced from various suppliers spread all over the world.

US tariffs and potential retaliatory tariffs will make aircraft and component imports costlier, which in turn would bump up aircraft manufacturing costs, which may be passed on to airlines, and ultimately to passengers. Tariffs are also likely to add to logistical complexities, which could potentially slow down or disrupt critical supply chains, which would then impede aircraft manufacturing, apart from further inflating and complicating cost structures.

Industry watchers caution that airlines may also be forced to delay aircraft purchases and deliveries due to higher costs, hurting demand for new aircraft while further heating up competition in the aircraft leasing market. Depressed new aircraft demand could then hit aircraft manufacturers, component makers, and their suppliers, potentially leading to capacity cuts and job losses in the sector.

The irony: US tariffs may badly hurt Boeing

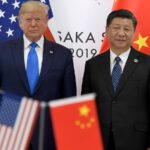

Although the Trump administration wants to protect and encourage American manufacturing and exports, the already embattled Boeing — among the country’s biggest manufacturers and exporters — might be hurt badly by tariffs, much more than its European rival Airbus. Import tariffs primarily tax importers, which in this case would be Boeing as it relies on innumerable imported parts to assemble and roll out its Made-in-America aircraft.

Boeing manufactures in the US, and tariffs on imports of components and specialised materials from anywhere in the world would drive up costs for the company, making its aircraft less competitive versus those of Airbus. And it would be next to impossible for Boeing to quickly swap foreign suppliers dealing in specialised material, machinery, components, and even software with American ones. It would be a herculean task that could take years, if not decades, and time is not a luxury a beleaguered Boeing enjoys.

Airbus, while doing most of its manufacturing outside the US, would also be negatively impacted to some extent, as it has assembly lines in the US to cater to its American customers, and production costs at these units are bound to jump. Additionally, Airbus also has some US-based suppliers, and in the event of tit-for-tat tariffs, sourcing parts from these suppliers would get costlier.

Beyond that, however, Airbus stands to gain significantly at Boeing’s expense from a protracted tariff war as the European company’s non-US manufacturing is unlikely to see major US tariff-related disruptions and cost . Over the medium to long term, the European aerospace giant could potentially gain market share in aviation markets outside the US, while Boeing’s footprint may progressively contract and be largely limited to the US market, industry experts and participants believe.

China presents a massive opportunity for Airbus, which already operates an aircraft assembly line in the country. If China – the world’s second-largest aviation market — stays off-limits for Boeing for an extended period, Airbus would be a major beneficiary. Even in other fast-growing aviation markets, including India, Boeing customers could be forced to knock on Airbus’s door if Boeing aircraft are priced out of the market.