The International Monetary Fund (IMF) in its latest economic outlook has slashed growth projections for most countries, including India, in the backdrop of trade tensions fuelled by US-imposed tariffs and global uncertainty. India’s growth forecast has been cut by 0.3 percentage points to 6.2 per cent from 6.5 per cent for the financial year 2025-26 and by 0.2 percentage points to 6.3 per cent from 6.1 per cent for the next financial year 2026-27.

“For India, the growth outlook is relatively more stable at 6.2 percent in 2025, supported by private consumption, particularly in rural areas, but this rate is 0.3 percentage point lower than that in the January 2025 WEO Update on account of higher levels of trade tensions and global uncertainty,” the report stated.

The real GDP growth for India for 2025-26, as per the Reserve Bank of India, is projected at 6.5 per cent lower than earlier projection of 6.7 per cent, with Q1 growth seen at 6.5 per cent; Q2 at 6.7 per cent; Q3 at 6.6 per cent; and Q4 at 6.3 per cent.

The IMF has also cut its forecast for global growth by 0.5 percentage point to 2.8 per cent for 2025 and by 0.3 percentage point to 3 per cent for 2026 from its January forecast. “The escalation of trade tensions and extremely high levels of policy uncertainty are expected to have a significant impact on global economic activity,” the report said. The forecast for growth in global trade was also slashed by 1.5 percentage point to 1.7 per cent.

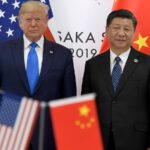

Growth in the United States is expected to slow to 1.8 percent, a pace that is 0.9 percentage point lower than the January projection, on account of greater policy uncertainty, trade tensions, and softer demand momentum, whereas growth in the euro area at 0.8 per cent is expected to slow by 0.2 percentage point.

In emerging markets and developing economies, growth is expected to slow down to 3.7 per cent in 2025 and 3.9 per cent in 2026, with significant downgrades for countries affected most by recent trade measures such as China. The growth forecast for China for both 2025 and 2026 is 4 per cent, 0.6 percentage points and 0.5 percentage points lower from the January forecast.

Going ahead, growth prospects are likely to be dented further by the ongoing trade war, the IMF said, adding that it could also damage the international financial system. “Ratcheting up a trade war, along with even more elevated trade policy uncertainty, could further reduce near- and long-term growth, while eroded policy buffers weaken resilience to future shocks. Divergent and rapidly shifting policy stances or deteriorating sentiment could trigger additional repricing of assets beyond what took place after the announcement of sweeping US tariffs on April 2 and sharp adjustments in foreign exchange rates and capital flows, especially for economies already facing debt distress. Broader financial instability may ensue, including damage to the international monetary system,” it said.